DCA

Tags:: #Financial_Freedom, #Financial_Management, #Definition, #Examples

Reference:: corporatefinanceinstitute

Dollar Cost Averaging

DCA is one of the most important concept that can minimize risk over time.

Setting aside a particular date to invest every month will help you invest consistently and also minimize risk as you're not making a lumsum payment, as predicting when to enter the market is nothing more than a coin toss. It's just luck! You either enter the right time or you don't.

Habits Although there are some golden days when you can clearly see it's the right time to invest but, can you ever be 100% sure about that is still a question you need to ask yourself. So creating a system that helps you minimize risk is the right way to approach the problem. Dollar cost averaging lets you do just that.

▶ Example

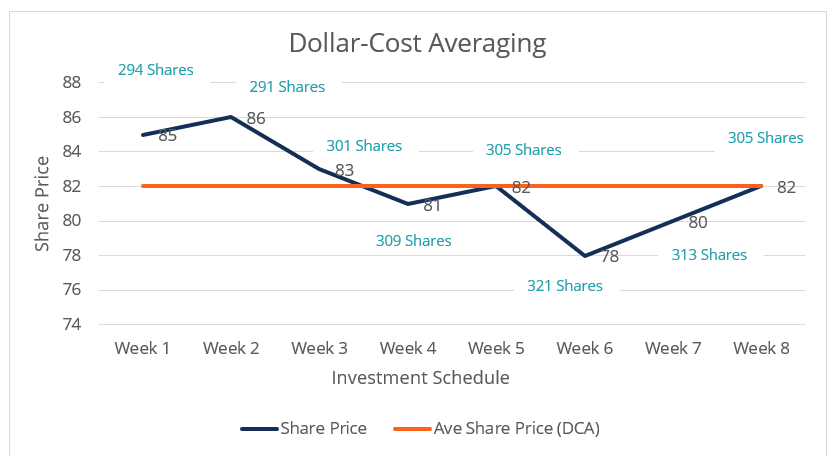

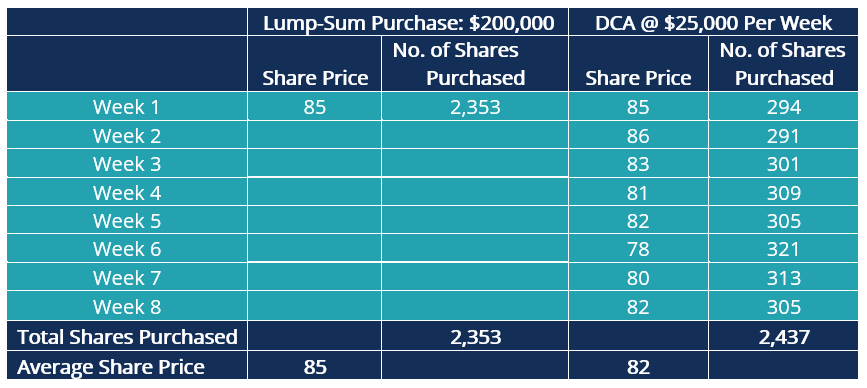

An investment of $200,000 in equities using DCA can be made over eight weeks by investing $25,000 every week in subsequent order. The table below illustrates the trades for lump-sum investment and DCA strategy:

The total amount spent is $200,000, and the total number of shares purchased with a lump-sum investment is 2,353. However, under the DCA approach, 2,437 shares are purchased, representing a difference of 84 shares worth $6,888 at the average share price of $82. Therefore, DCA can increase the number of shares purchased when the market is declining and can lead to fewer shares purchased if the share price is rising.

The dollar-cost averaging example above is better explained diagrammatically as below: